EIC Monitor report on energy sector in 1Q15

The latest EIC Monitor report once again shows a significant decline in the levels of contracting activity across global upstream, midstream and downstream sectors in 1Q15. Overall figures show the number of major contract awards made since the last quarter contracting by 30% following a previous decline in the preceding quarter. However, despite the overall number of contracts being awarded dropping, the value of some is substantial. But while long-term investment plans and new discoveries hold promise for the long term, these could take a long time to come to fruition for industry players. The number of major contract awards across the global oil and gas industry has steadily declined during the last quarter (Q1: Jan-Mar 2015), dropping to 95 contract awards, a 30% decrease compared to 136 in 4Q14, and just 64% of the 149 contracts awarded in 1Q14.

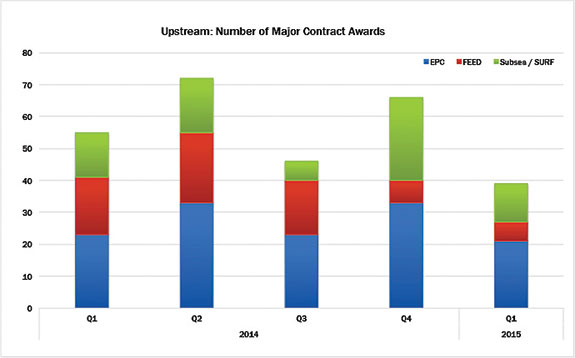

Upstream contracting activity in 1Q15

In 1Q15, a total of 39 major contracts – EPC (Engineering, procurement & construction), FEED (front end engineering design) and subsea/surf (subsea, umbilicals, risers & flowlines) – were awarded across 30 upstream developments, falling 65% from 66 awards in 4Q14 and compared to 55 awards in 1Q14. A total of 21 EPC contracts, 6 FEED contracts and 12 subsea/surf contracts were awarded.

EPC activity

The US, Ghana, Malaysia and Norway have seen significant activity, accounting for 11 EPC contracts across 6 different upstream developments. In the US, there were two EPC contracts for the Stampede oilfield, with Kiewit securing a contract to carry out the topsides fabrication and Samsung Heavy Industries the hull fabrication.

There has been significant activity on the Cape Three Points Block (OCTP) – Sankofa and Gye Name Discoveries in Ghana with four separate contracts being awarded. PetroVietnam Technical Services Company (PTSC) and Kanfa Group are each supplying four topsides modules for the FPSO, GE Oil & Gas is providing three gas turbines and four centrifugal compressors, and Yinson Holdings the FPSO, with a value of over US$2.5 billion making it one of the larger contracts in the quarter.

In Malaysia, state-owned oil company Petronas awarded Hyundai Heavy Industries an EPC contract for the central processing platform (CPP) on the Baram Delta gas gathering project, and Hess Corporation awarded E.A. Technique a contract to supply a floating storage and offloading (FSO) unit for Block PM301 (North Malay basin development).

The North Sea off Norway has seen two EPC contracts for the Johan Sverdrup development (Avaldsnes and Aldous Major South Oil Discoveries), both awarded by Statoil. ABB won a contract for land-based power supply for phase 1 of the development and Aibel was awarded a contract worth over US$1 billion for drilling platform topsides. In the Gina Krog oil & gas field, IKM Ocean Design was awarded an EPC contract by Statoil to supply the Zeepipe IIA Gooseneck Spool and retrofit hot tap tee. Injection gas to the field will be supplied through a 16 in. pipeline connected to the 40 in. Zeepipe IIA pipeline via a 12 in. spool. The connection will be accomplished by hot-tapping and tie-in to a 40 in. by 12 in. retrofit tee.

Petrofac is leading a consortium with Greece-based Consolidated Contractors Company (CCC) awarded a US$4.3 billion contract by Kuwait Oil Company (KOC) for the Lower Fars heavy oilfield development in Kuwait. The companies are providing EPC, start-up and operations and maintenance work for the main central processing facility (CPF) and associated infrastructure as well as the production support complex.

In Kazakhstan, North Caspian Sea Operating Company (NCSOC) awarded Saipem a contract worth US$1.8 billion to build two 95 km pipelines. The significant value of these contracts demonstrates that while the overall number of awards has reduced, the value of those being made is still substantial.

FEED activity

In 1Q15, six upstream FEED contracts were awarded, of which two were in the USA, both awarded to IntecSea by Chevron for providing engineering and long-lead procurement services on subsea-tie backs for the Buckskin and Moccasin offshore oilfields. In Brazil, CFPS Engenharia e Projetos was awarded a contract by Parnaíba Gás Natural (PGN) for the Block BT-PN-8 - Gavião Branco gas field.

In the UK, Ramboll was awarded the detailed design contract by Maersk Oil for two jackets for a central processing facilities platform and utilities/living quarters platform in the Culzean HPHT gas and condensate field.

Tecnomare secured a contract with Eni for the Nene-Loango development project in Congo, and Wood Group Kenny is to provide FEED work for the flowline system, including engineering and procurement support, for North West Shelf venture offshore Australia.

Subsea/surf activity

Ghana and the USA have dominated subsea/SURF contracts, accounting for three deals each across six separate projects. In Ghana, a joint venture of GE Oil & Gas and Oceaneering International is supplying a subsea production system for Eni Ghana E&P in the Cape Three Points Block. DeepOcean was awarded two contracts by Tullow Ghana to provide inspection, survey and subsea construction services on the Deepwater Tano Block and Jubilee Field.

1Q15 saw Oceaneering International awarded three subsea/SURF contracts in the USA; one to provide umbilical installation tiebacks in Marmalard North and Marmalard South, another to supply subsea production umbilicals for the Odd Job offshore oilfield, and a third to provide umbilicals and umbilical distribution hardware at the Stampede oilfield.

Elsewhere, Technip won two subsea/SURF contracts; one to supply 200 km of flexible lines and related equipment for the Lula Alto field's production system in Brazil, and another to carry out the fabrication and installation of pipeline and umbilicals for the UK’s Glenlivet & Laxford gas fields.

Subsea 7 won a deal for fabrication and subsea installation on the Persephone gas field, part of Australia’s North West Shelf project. Also in Australia, Ezra Holdings secured a deal for umbilicals, manifolds, flying leads and jumpers in the Julimar gas field.

In Norway, Nexans is supplying standardised umbilical cables for the Visund Nord oil and gas field, and finally in Denmark, VBMS is carrying out the installation of 18.5 km of control umbilicals at the Ravn oilfield.

Midstream contracting activity in 1Q15

In 1Q15, a total of 33 major contracts (EPC, FEED and Pre-FEED) were awarded across 24 midstream developments, decreasing 15% from 39 in 4Q14, and 19.5% from 41 contract awards in 1Q14. Of these, 25 were EPC, four FEED and four pre-FEED. Notably, there were no pre-FEED contract awards at all in 4Q14 or 1Q14, so these new examples are significant for development as they are likely to go forward.

North America dominates midstream activities because of its focus on LNG liquefaction and construction on a number of pipelines for export. Despite an overall global slowdown in LNG, progress in US and Canada continues.

EPC activity

Out of a total of 25 midstream EPC contracts, Argentina has seen six awards totalling thousands of kilometres of trunk and branch lines for the Gasoducto del Noreste Argentino gas pipeline (GNEA), which looks set to be a considerable project.

The US has seen the greatest number of awards – a total of eight contracts for eight separate projects represents 32% of all midstream EPC contracting activity. One of these, the largest midstream EPC in the quarter, was a US$2 billion award to a consortium of CB&I, Chiyoda Corporation and Zachry Industrial for the LNG train and storage tank for the Freeport LNG liquefaction train 3. To be built at an existing terminal, the new liquefaction facility will provide a nominal export capacity of approximately 13.2 million tpy of LNG.

Other important contracts in the US include an award to a JV of KBR and SK E&C to carry out EPC of the initial two LNG production trains with provision for two additional trains for the Magnolia LNG export terminal; and a consortium of CICSA, Energy Transfer Partners and MasTec was awarded the contract to construct and operate the Waha-Presidio natural gas pipeline.

In the MENA region, all three EPC contracts were for the Gasco Integrated gas development (IGD) expansion in United Arab Emirates. They were awarded to National Petroleum Construction Co (NPCC), a JV of Archirodon Group and Tecnimont, and Tecnicas Reunidas.

There were two awards in Russia, to Mezhregiontruboprovodstroi OJSC (MRTS) for the Yamal LNG plant and to Stroygazconsulting for the Zapolyarny to Purpe oil pipeline. Africa also saw two awards, to Taleveras Group for the construction of the Bioko Island oil storage terminal and to a JV of China Harbour Engineering Company (CHEC);Roads Contractor Company (RCC) for the Walvis Bay storage terminal.

Finally, there were single awards in Australasia and the Indian sub-continent – to McConnell Dowell for the Ichthys LNG plant in Darwin, and to the China Petroleum Pipeline Bureau (CPPB) for the Gwadar LNG import terminal in Pakistan.

FEED activity

There were four midstream FEED contract awards in 1Q15. In Oman, WorleyParsons has been appointed as a FEED contractor for the Duqm liquids terminal and Amec Foster Wheeler has been awarded a contract for the Duqm oil storage terminal and pipeline.

The other two were in the US where QPS Engineering has been appointed to carry out the FEED for the Maurepas pipelines project and AECOM for Energy Transfer Partners’ ET Rover pipeline project for the Marcellus and Utica Shale formations.

Downstream contracting activity in 1Q15

In 1Q15, a total of 23 major contracts (EPC, FEED and PMC - Project Management Contract) were awarded across 21 downstream developments, decreasing nearly 26% from 31 awards in 4Q14, and 57% from 53 contract awards in 1Q14. A total of 13 EPC contracts, 6 FEED contracts and 4 PMC contracts were awarded.

The US dominates the sector predominantly through petrochemical plants producing ammonia and urea for fertiliser, including Cronus Chemicals’ US$1.5 billion Tuscola Ammonia and Urea Plant. There were also two contracts for EPC and FEED for Tecnicas Reunidas at the Valleyfield titanium dioxide plant in Canada.

Europe has seen an increase in activity during the last quarter due in part to lower feedstock prices leading to higher margins on a number of refineries and petrochemical complexes. Jacobs Engineering benefitted from this with an EPC contract for the Geel purified terephthalic acid (PTA) plant upgrade in Belgium and a FEED contract for the Gelsenkirchen refinery hydrotreater upgrade in Germany.

EPC activity

North America and Europe have been key focal points for downstream activity in 1Q15, with both regions seeing four EPC contracts across four downstream developments. Among the key European contracts, SNC Lavalin won a contract to carry out process design, basic and detailed engineering services, equipment, training and assistance during the commissioning and start-up stages of the Tirgu-Mures ammonia and urea plant modernisation in Romania. And in Hungary, ThyssenKrupp is carrying out EPC for a new nitric acid plant as part of the Petfurdo ammonia plant upgrade.

FEED activity

Three out of six downstream FEED contracts awarded in 1Q15 were for projects in North America. In the US, Air Liquide E&C Solutions won a contract to provide engineering services for the Freeport methane-to-propylene plant, Amec Foster Wheeler was awarded work on the syngas-to-liquids plant of the West Texas renewable and gas monetisation project, and Tecnicas Reunidas won a contract for the Valleyfield titanium dioxide plant in Canada.

In Mexico, Sener Engineering Pemex appointed Sener Engineering a contract to carry out detailed engineering for the modernisation of units at the Antonio Amor refinery ULSD Project in Salamanca.

There were also two significant project awards in Europe; CB&I for the Parcevo refinery delayed coker unit in Serbia and Uhde Inventa-Fischer for the Tarnow polyamide 6 plant.

PMC activity

Two of the four downstream PMC awards in 1Q15 were for projects in the Russia and Caspian region. China Machinery Industry Construction Group won a contract to act as project coordinator for the Novosibirsk refinery modernisation project in Russia, and Fluor is working on the Garadagh oil, gas processing and petrochemical complex in Azerbaijan. Amec Foster Wheeler was awarded the remaining two downstream PMC contracts; for the Fujairah bio fuel refinery in the UAE and for the Ningxia coal-to-chemical plant in China.

Submitted by Energy Industries CouncilEdited for web by Cecilia Rehn.

Read the article online at: https://www.hydrocarbonengineering.com/special-reports/29042015/eic-monitor-report-on-energy-sector-in-1q15/

You might also like

The Hydrocarbon Engineering Podcast - Education and training for every phase of the insulating system design process

In this episode of the Hydrocarbon Engineering Podcast, Brandon Stambaugh, Owens Corning Director for Technical Services, joins us to discuss engineers’ demand for education and training to support the critical phases that affect the performance and longevity of insulating systems.

Tune in to the Hydrocarbon Engineering Podcast on your favourite podcast app today.