Energy market impacts on fuel and petrochemical prices

Published by Callum O'Reilly,

Senior Editor

Hydrocarbon Engineering,

The recent spate of news articles referencing the ‘global energy crunch’, ‘unseasonably high gas prices’ and ‘chemical shortages’, while informative, offer little insight on how these issues — and their impacts — are intertwined. Susan Grissom, the Chief Industry Analyst for the American Fuel & Petrochemical Manufacturers (AFPM), provides a high-level look at the dynamics affecting global energy markets and how they affect the prices businesses and consumers pay for fuel and petrochemical products.

Rising price of feedstocks

Increased US production of crude oil, natural gas and gas liquids have provided manufacturers in the US, including those in the fuel and petrochemical sectors, with a significant global competitive advantage. This increase in US production has supported lower fuel and feedstock costs, and combined with the unrivalled manufacturing efficiency and complexity of the US industries, has resulted in almost a decade of average national gasoline prices remaining under US$3.

But the COVID-19 pandemic upended the energy markets. Demand disappeared and energy producers scaled back. Now that economies are reopening, and the demand for goods and services is rebounding, the demand for energy all along the supply chain is increasing, driving up not only the cost of the feedstocks and fuels refineries and petrochemical manufacturers use, but also the cost of the energy used at every step of the supply chain.

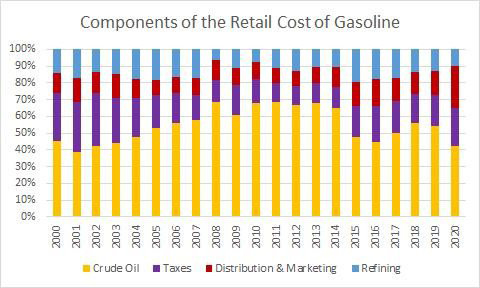

Figure 1 illustrates that crude oil consistently accounts for the largest portion of consumer gasoline prices, while the refining sector margins are small and shrinking. These skinny refiner margins mean there is little ability for refiners to absorb crude oil price increases—and crude oil prices are now at the highest since 2014; they must be passed along to consumers as higher gasoline prices. Spiking natural gas prices — the highest in more than a decade — are similarly driving up the cost of feedstocks for petrochemicals and the cost of fuel for both refiners and petrochemical manufacturers.

Figure 1. Retail gasoline cost drivers include the cost of crude oil, federal and state taxes, fuel distribution and marketing expenses, and, finally, the cost of fuel refining (source: AFPM analysis of US Energy Information Administration data).

The ‘shortage of everything’

The COVID-19 pandemic has disrupted, strained and twisted supply chains and consumer demand in ways unseen in modern history. The demand for jet fuel tanked almost overnight, for instance, while the demand for chemicals needed to produce PPEs and hand sanitizer surged. Lockdowns and COVID outbreaks destabilised global production, labour and transportation systems in ways that will likely affect supply chains for the foreseeable future.

The erroneously labelled gasoline shortages this summer, for instance, were in fact largely a shortage of truckers to deliver fuel; refinery production levels were not the problem. A similar shortage of fuel tanker drivers has been a major factor behind the UK’s current gasoline shortage. Widespread shipping, rail and road transport problems have ensured that our supply chains remain fragile, overwhelmed and prohibitively expensive — adding yet another spur to higher prices.

These supply chain woes were further exacerbated by natural disasters, with last winter’s freeze in Texas causing serious supply disruptions to natural gas and petrochemical production, while the impact of this year’s hurricanes significantly impacted Gulf Coast oil production.

All of these events have combined to create what is being called ‘the shortage of everything’. A shortage of people is driving up labour costs. A shortage of commodities is driving up material costs and feedstock costs. And since you need energy — and people — to make energy and to deliver energy, all of these shortages are having an outsized effect on fuel and petrochemical prices, which in turn have significant knock-on effects due to their economic importance to businesses and consumers.

Fertilizer, for example, is made from ammonia (derived from natural gas) and CO2; as the prices for both commodities rise, the cost of fertilizer will spike and in turn drive up food prices.

Exacerbating factors

There are a number of considerations that further confound these already turbulent energy markets, including ongoing COVID-19 impacts, global oil market considerations, and the energy transition:

Ongoing COVID-19 impacts

The COVID-19 pandemic devastated energy production sectors. As demand plunged, companies reacted by reducing operations and laying off workers. The rapid, if uneven, economic recovery and accompanying energy demand caught these industries off guard, leaving oil and natural gas production lagging behind demand. This gap has been exacerbated by producer hesitance to ramp up production given the ongoing demand uncertainties accompanying the pandemic, as well as their own version of ‘the shortage of everything’, which includes labour shortages, delays in getting parts and other supply chain bottlenecks.

Global market considerations

During AFPM’s recent Summit, Turner, Mason & Co. Executive Vice President John Auers noted much of the spare capacity for crude oil production currently rests in the Middle East. The region has vast reserves and an interest in monetising those reserves, but thus far the Organization of the Petroleum Exporting Countries, Russia and their allies (known as OPEC+) have ignored calls from the Biden administration and others to increase production and instead are sticking to the agreed-to production plan of increasing 400 000 bpd in November. Oil analysts are now saying a crude oil price of US$100/bbl is not out of the question; for reference, oil was trading at less than US$40 a year ago and at less than US$65 in June of this year. Oil is now trading at US$80. The recent run up in prices has been fuelled by a belief among traders that natural gas shortages will cause increased oil demand as businesses and consumers switch to using petroleum derived fuels such as diesel and heating oil in lieu of natural gas. And as crude oil prices go up, gasoline, diesel and heating oil prices go up as well.

The ‘transition premium’

Countries are seeking to reduce the carbon intensity of their economies, and many have turned to natural gas to generate electricity as a way to lower emissions as they phase out coal. Natural gas-fired generation also provides back up for increasing wind and solar powered generation, when those are not available, as has recently been the case for wind power in the UK. Many countries are also looking to electrify their transportation fleets, thus increasing demand for electricity that increasingly relies on natural gas. As a result, demand for natural gas has grown rapidly, and right now demand is outpacing supply and natural gas prices around the world are going up. In Europe and Asia natural gas prices are skyrocketing. Prices in the US are moving higher as well and are the highest they have been in more than a decade. But the price increase in the US has been less dramatic. The US is the largest producer of natural gas in the world and relies primarily on domestic production for supply, while Asia and Europe rely on imported natural gas.

Policy impacts

Domestic policies that are being debated — and those that have already been enacted — have also affected fuel and petrochemical prices. Annual Renewable Fuel Standard (RFS) compliance is costing refiners more than it ever has in its 15-year history, with individual ethanol credits earlier this year selling for 19 times the prices seen in January 2020. Compliance costs could approach US$30 billion this year, adding yet more expense to each gallon of gasoline and diesel manufactured in the US. And should the bank of renewable identification numbers (RINs) needed to comply with the RFS run out — which some estimate could happen in the next year or two — refiners would have little choice but to refine less gasoline, diesel and jet fuel to avoid fines from the Environmental Protection Agency (EPA).

Policies intended to accelerate the energy transition, including those to limit or ban internal combustion engines — such as President Biden’s executive order this summer setting a goal that half of all new vehicle sales in the US be electric by 2030 — are collectively having a chilling effect on upstream investments and production.

These types of lending restrictions — exacerbated by leasing restrictions for oil and natural gas extraction on federal lands — make it more difficult for US producers to ramp up production, increasing our reliance on OPEC+ countries. Regulatory and policy hurdles, moreover, have undermined midstream infrastructure development, further threatening the efficient movement of feedstocks.

Recent outlooks published by the International Energy Agency (IEA) and Energy Information Administration (EIA) paint a clear picture that global energy needs are going to rise significantly in the decades to come, reflecting population growth, more nations progressing out of poverty and the expansion of transportation and technology systems worldwide. Policies at the federal, state and international levels that focus single-mindedly on pushing fossil energy out of the market seem to have blinders up regarding these demand projections. Artificially limiting global energy supply and barring access to some of our most energy-dense feedstocks could put in jeopardy our collective ability to provide sufficient, affordable energy for the next generations. This dual challenge — the need for more sustainable energy today and the imperative to meet the energy needs of tomorrow — must be factored into our present policy decisions.

The bottom line

The fuel and petrochemical industries are constantly working to provide US consumers and the global markets with the refined products and petrochemicals needed for modern life. But they cannot set crude oil or natural gas prices, nor can they offset foreign or domestic policies that are driving up the cost of feedstocks and labour. Until these components are addressed, consumers and businesses are likely to see higher prices.

Written by Susan Grissom, Chief Industry Analyst, AFPM. To view the original blog article, click here.

Read the article online at: https://www.hydrocarbonengineering.com/special-reports/26102021/energy-market-impacts-on-fuel-and-petrochemical-prices/

You might also like

The Hydrocarbon Engineering Podcast - Education and training for every phase of the insulating system design process

In this episode of the Hydrocarbon Engineering Podcast, Brandon Stambaugh, Owens Corning Director for Technical Services, joins us to discuss engineers’ demand for education and training to support the critical phases that affect the performance and longevity of insulating systems.

Tune in to the Hydrocarbon Engineering Podcast on your favourite podcast app today.