EIA: crude oil prices to decline

Published by Bella Weetch,

Editorial Assistant

Hydrocarbon Engineering,

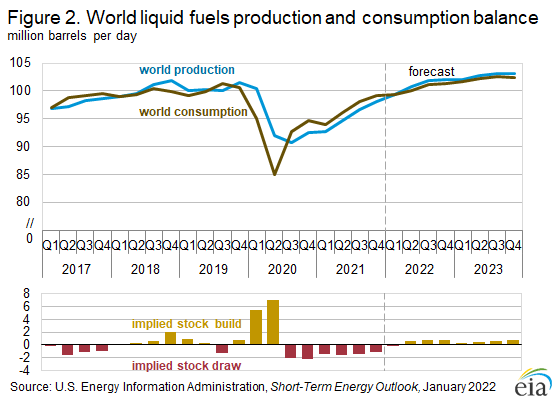

Global oil consumption outpaced oil production for the six consecutive quarters ending with 4Q21, which has led to persistent withdrawals from global oil inventories and significant increases in crude oil prices. Crude oil production remained restrained as a result of curtailments by OPEC+ members, investment restraint from US oil producers and other supply disruptions. In 1Q22, however, the EIA forecasts that global oil markets will be balanced and that rising production will contribute to inventory builds in 2Q22 and continuing through 2023.

The inventory draws from 3Q20 to 4Q21 put upward pressure on crude oil prices. It is expected that the forecast inventory will build from 2Q22 to 4Q23, conversely, to put downward pressure on crude oil prices. The price of Brent crude oil averaged US$71/bbl in 2021, and it is forecasted that the price will fall from the current price of around US$80/bbl to average US$75/bbl in 2022 and US$68/bbl in 2023 (Figure 1).

Figure 1.

During 2021, the Brent price reached its highest monthly average, US$84/bbl, in October and then fell to an average of US$74/bbl in December. The price decline largely reflected concerns about how the Omicron variant and potential mitigation efforts may affect near-term oil demand. However, crude oil prices ended December at US$77/bbl as concerns eased that Omicron would lead to significant declines in oil consumption. In addition, 0.3 million bpd of crude oil production went offline in Libya, contributing to the increasing oil price.

The EIA expects the Brent crude oil spot price will average US$75/bbl in 2022. It is forecasted that the Brent price will remain near current levels in 1Q22, averaging US$79/bbl for the quarter. Oil markets are essentially balanced in 1Q22 in our forecast, and inventories decline slightly. From 2Q22 through 4Q22, however, it is expected that inventory builds will average 0.7 million bpd and that these inventory builds will put downward pressure on oil prices during this period.

Additionally, it is forecasted that Brent crude oil prices will fall to an average of US$71/bbl by 4Q22. In 2023, the EIA expectsthat global inventories will build by an average of 0.6 million bpd, and that the Brent crude oil price will average US$68/bbl (Figure 2).

Figure 2.

Read the article online at: https://www.hydrocarbonengineering.com/refining/13012022/eia-crude-oil-prices-to-decline/

You might also like

The Hydrocarbon Engineering Podcast - Education and training for every phase of the insulating system design process

In this episode of the Hydrocarbon Engineering Podcast, Brandon Stambaugh, Owens Corning Director for Technical Services, joins us to discuss engineers’ demand for education and training to support the critical phases that affect the performance and longevity of insulating systems.

Tune in to the Hydrocarbon Engineering Podcast on your favourite podcast app today.