Offshore rig construction market to 2016

The current scenario as of early 2013, and the expected scenario in the next five years, signals a strong demand for deepwater and ultra-deepwater rigs, with multiple newbuild orders for semi-submersibles and drillships pending in various shipyards worldwide, especially in South-east and East Asia, and South Korea, as a result of operators worldwide showing a bullish trend for hiring semisubmersibles and drillships.

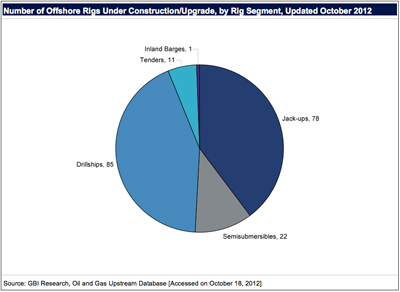

Attempts to explore and produce hydrocarbons from basins in deepwater and ultra-deepwater offshore areas are being positively evaluated by offshore E&P players in offshore regions worldwide, which involves operations exceeding water depths of 500 and 5000 ft, respectively. Despite this kind of exploration being a riskier activity, offshore E&P players hope to benefit from the increasing promise of hydrocarbon reserve potential gains in such high-risk activities as ultra-deepwater or harsh-environment exploration, which is driven by rising demand, and hence surging crude oil prices. This scenario is expected to drive the demand for deepwater and ultra-deepwater rig segments such as drillships and semi-submersibles; and subsequently business for rig construction shipyards associated with deepwater and ultra-deepwater rig construction in shipyards worldwide. As of October 2012, the newbuild rig construction scenario in terms of the statistics of offshore rigs under construction worldwide could be explained in the form of the chart below:

Summary of worldwide in-service offshore rigs and newbuilds currently under construction

The table below represents the current status and number of offshore rigs currently in service worldwide, as of October 2012, and the expected number of newbuilds, by rig type.

High offshore day rates pushing demand for rig upgrades in the form of new changes in blow-out preventer (BOP) applications

As offshore exploration and production companies seek to hire offshore rigs with enhanced safety equipment and ones with minimal equipment maintenance costs and operational time requirements, the market demand and subsequently prices for blow-out preventers (BOPs) with the latest designs are also expected to be on the rise as E&P players seek to minimise maintenance delays and shorten drilling times, which can at times cost more than US$ 600 000 per day. Newly designed offshore rigs also require regular repair and maintenance checks in order to minimise drilling days to control costs and speed up operations.

Hence, since 2012, major BOP manufacturers such as Cameron Corp. and National Oilwell Varco are expected to witness a rise in their business because of the rising demand for BOPs. An emerging concept in 2012 has been of new rigs requiring two BOPs – one of them as a backup device that could be immediately lowered to replace the one being sent for maintenance, thus avoiding hampering of drilling operations and thereby saving time.

New rig orders being driven by stringent safety regulations, ageing of old rigs, and the demand for harsh-environment rigs

The stringent safety regulations associated with offshore drilling operations in deepwater and ultra-deepwater rigs are expected to drive technical modifications in offshore rigs to update them with technologically safer equipment meeting new compliance standards. BOP technology has been a major focus area with regard to technology-based expectations to make offshore rigs safer and meet the increasingly stricter compliance standards being set by various regulatory bodies in different countries.

The ageing of older offshore rigs along with their increasing non-compliance with newer technology requirements stemming from mandatory safety norms have also been driving newbuild rig investments by offshore drilling contractors. Besides this, rising oil and gas prices are expected to make deepwater exploration, drilling and production operations more attractive in terms of commercial viability as well as from a risk-worthy perspective. The current trend has thus been that offshore drilling contractors have been keen to invest in developing next-generation offshore rigs. It should also be noted that the surge in orders for newbuild offshore rigs indicates strong investments by the offshore oil and gas industry for the future, despite a financially uncertain atmosphere in the world economy.

In recent times, there have been developments in terms of new offshore rig designs for operational implementation in extremely challenging geographical environments. For instance, in February 2012, Keppel Offshore and Marine Technology Centre, the design and engineering division of Keppel Offshore and Marine along with US oil supermajor ConocoPhillips declared that the two companies would be jointly coming with a new jack-up rig design making the unit capable of drilling in ice in one of the harshest offshore environments, such as the Arctic region. The design project is expected to be completed by the end of 2013. The jack-up is being designed for self-sustained operation for 14 days and is also fitted with a hull with the capability of towing in ice. It is expected to resist impacts from ice floes and ridges and withstand ice environments.

Time delays in projects along with high manufacturing costs due to competition proving to be unfavourable to the Brazilian offshore rig construction industry

In August 2011, the management of Sete Brazil, the leading offshore rig construction shipyard in Brazil, expressed concerns that the poor Brazilian labour market had increased inflation and that the cost of rig manufacturing in Brazilian shipyards had grown high enough to no longer be cost competitive with relation to South Korea. It was found in August 2011 that offshore rigs constructed in Brazil were 15% more expensive than those built in South Korea (Reuters, 2011). In addition, many offshore rigs built in Brazil do not meet international industry norms. The country’s poor labour market and inadequate industry workforce training were other factors that contributed to the economically unattractive cost of production in Brazil. If this situation persists, it could damage business in the Brazilian rig construction industry.

Also, for instance, as of November 2012, the Estaleiro Atlântico Sul (EAS) shipyard in Brazil has developed a massive backlog in terms of its newbuild offshore rig orders, has displayed a relatively unattractive operational cost-effectiveness and lacks technical expertise compared to its global counterparts in places such as South Korea. Additionally, the EAS shipyard has been having issues in trying to build a strong local supply source for parts and components. The Brazilian government has mandated that at least two-thirds of the content used at the shipyard be sourced from within the country. Another associated issue has been with the ability of local suppliers to prove their qualification for such a specialised requirement, meeting business protocols, labour quality and costs, and environmental specifications.

Business strategy by shipyards to diversify into deepwater rig construction and subsea equipment manufacturing propelling their profit margins

To tackle the slowdown in business caused by a slump in the shipbuilding industry, shipyards have been venturing more into the high-margin, high-demand deepwater rig construction industry and the subsea technology and equipment market. The subsea hydrocarbon production facilities are expected to witness market growth from around US$ 27 billion in 2011 to around US$ 130 billion in 2020, and as a result shipyards have recently been looking to diversify their business in this particular segment. For instance, South-east Asian shipyards have been strongly considering joint ventures, acquisitions, and mergers with subsea technology companies to venture in this new avenue. Samsung Heavy Industries has been contemplating acquiring overseas companies to gain access to intricate subsea equipment installation and offshore production technology.

To mention an example, the British multinational consultancy, engineering and project management company AMEC, in a joint venture (JV) with Samsung Heavy Industries, AMEC Samsung Oil and Gas LLC (ASOG), is expected to perform the design engineering work for fixed platforms, floating offshore platforms, and subsea pipelines for the latter, according to a declaration by AMEC in October 2012. The JV is expected to merge an advanced system of design engineering capability along with the project management expertise and rig building forte of Samsung Heavy Industries for success.

Written by GBI Research, UK.

Read the article online at: https://www.hydrocarbonengineering.com/special-reports/06032013/offshore_rig_construction_market_2016/

You might also like

The Hydrocarbon Engineering Podcast - Education and training for every phase of the insulating system design process

In this episode of the Hydrocarbon Engineering Podcast, Brandon Stambaugh, Owens Corning Director for Technical Services, joins us to discuss engineers’ demand for education and training to support the critical phases that affect the performance and longevity of insulating systems.

Tune in to the Hydrocarbon Engineering Podcast on your favourite podcast app today.