US crude oil inventories forecast to rise by 3.6 million bbls

Published by Joseph Green,

Editor

Hydrocarbon Engineering,

WTI crude oil has been in an uptrend for the past month, with signs of a peak in US production and a possible delay in negotiations with Iran, coupled with the current unrest in Yemen, which has several major Opec producers pitted against each other.

The weekly inventory report from the US due later today should give us some further clues on when production will begin to taper off.

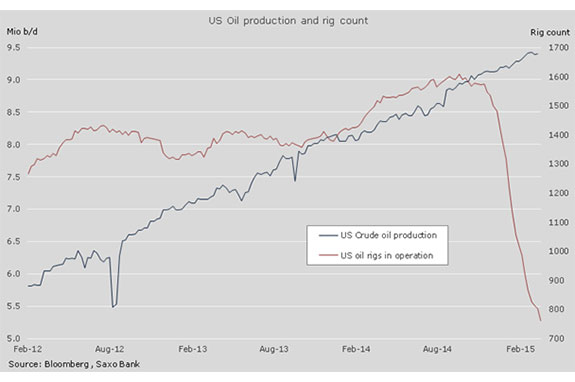

US production reached 9.4 million bbls per day during the week of 8 April, which was a small positive reversal on the previous week. The dramatic cut in US rig count since October will eventually and most likely within the next few weeks begin to negatively impact US production.

This is forecast to happen by both the EIA and the IEA, which in its monthly report today saw shale oil production falling by 160 000 bbls per day during the second half of 2015.

While US production is expected to slow, the same can not be said about Opec, which according to the IEA, increased production above 31 million bbls per day in March. A further rise is expected for April.

This amounts to around 2.5 million bbls per day more than the global oil market currently requires and this should help cap the near-term upside in oil markets, not least considering Iran's stated ambition of increasing production and exports as soon it will be allowed to do so.

Analysts are forecasting that US inventories rose by 3.6 million bbls in the week ended 10 April.

Overall inventory levels remain very elevated, both nationally and at Cushing, the delivery hub for WTI Crude oil futures.

Edited from report by Joseph Green

Report by Ole Hansen, Head of Commodity Strategy at Saxo Bank.

Read the article online at: https://www.hydrocarbonengineering.com/special-reports/16042015/us-crude-oil-inventories-rise-613/

You might also like

IOCL selects Lummus' cumene technology

The new cumene unit is part of a grassroots petrochemical and polymers expansion at IndianOil's complex in Paradip, India.